AUSTRALIAN INSTITUTE OF ENERGY

ENERGY ISSUES IN MOTION

Australia faces several unique challenges regarding energy supply. Although it accounts for only 0.33% of the world’s population, the country spans the fifth-largest landmass globally and boasts 35,877 km of coastline, with 95% of the population living within 100 km of the coast. As a result, most critical infrastructure has been developed along coastal areas close to population centres.

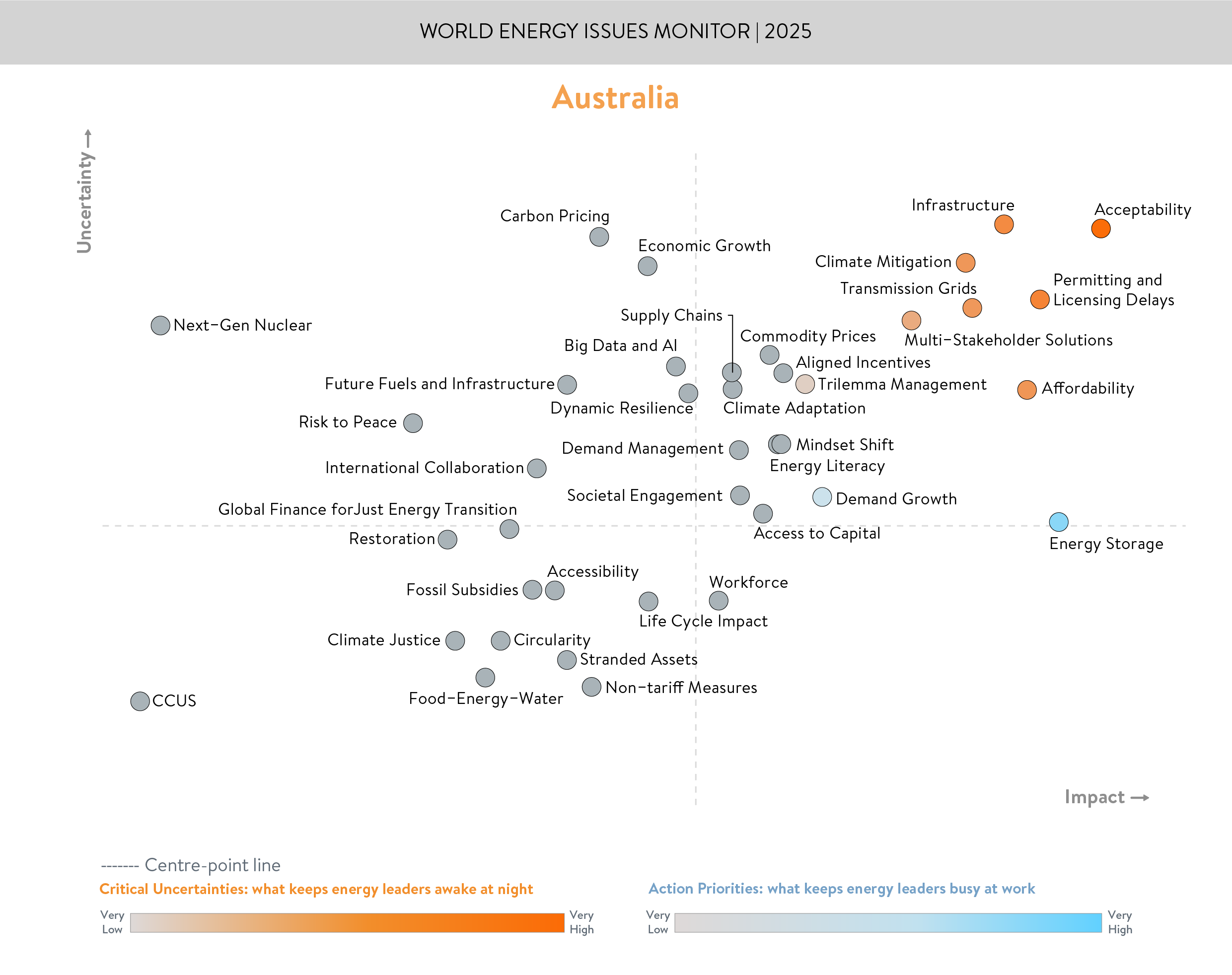

Many of Australia’s key energy issues relate to the stationary energy and electricity sectors, particularly the transition from a heavy reliance on fossil fuel generation to renewable energy solutions.

While there are plans for the closure of existing coal-fired generation, a major question remains: can this generation capacity be replaced in a timely manner? Based on government data, fossil fuels accounted for 90.5% of electricity generation in 1998, decreasing to 63.9% in 2023, still leaving a significant gap to meet proposed targets.

Regional electricity networks experience higher per-customer costs due to longer geographic distances and lower population density, further impacting affordability.

The debate over land use, particularly the tension between energy and food production, has subsided in recent years. Thanks to Australia’s vast land availability, large-scale energy projects can now be developed in areas where community and environmental concerns are more easily addressed. However, this does not negate the continued need for expanded transmission infrastructure, nor the effect this has on energy affordability.

The role of domestic solar PV growth and its contribution to the future energy mix cannot be overlooked. Australia leads the world in per capita deployment of solar PV, driven primarily by high rates of residential installations. The combined capacity of residential solar PV, batteries, and electric vehicles (EVs) is expected to reach 30% by 2030 and 45% by 2050. Much of this growth will depend on multi-stakeholder solutions, including the rollout of vehicle-to-grid (V2G) infrastructure — requiring both regulatory and infrastructure development.

While there has been a notable increase in large-scale wind and solar projects, many have not reached expected levels due to challenges highlighted in the World Energy Issues Survey, including delays in permitting and licensing, transmission constraints, and the need for energy storage solutions.

As in many countries, Australia faces a moving target: expected demand growth is outpacing the speed at which new generation can be brought online. The government is actively promoting (and investing in) the growth of domestic manufacturing, with an emphasis on relocating expansion to regional areas where planned renewable generation can be directly utilized, reducing the reliance on major transmission projects. Certain business sectors, such as data centres, are projecting electricity demand to grow by 165% by 2030.

Australia is also addressing the link between energy and climate change, aiming to reduce greenhouse gas emissions and transition to a low-carbon economy, while ensuring reliable and affordable energy. The national emissions reduction target is 43% below 2005 levels by 2030, with a goal of achieving net-zero emissions by 2050.

Although climate mitigation received little mention in recent discussions, Australia operates a National Greenhouse and Energy Reporting Scheme. This framework is being gradually phased in and serves as a key driver for business decisions regarding energy efficiency measures and renewable energy deployment.

FROM BLIND SPOTS TO BRIGHT SPOTS

The regulatory pathway for regulatory and licencing approvals is an area that needs to be further prioritised with delays being seen at all levels of Government. The current processes in Australia can require approvals from Federal, State and Local Governments as well as the Networks, with the process needing to be streamlined if targets are to be met. The uncertainty surrounding the timing of these processes is affecting the access to capital, resulting in may projects failing to progress due to changes in supply chain pricing and availability.

With Australia having the highest per capita deployment of rooftop solar in the world (primarily led by household installations), we are seeing energy retailers move to position of no longer offering any payment for surplus generation fed back into the grid from C & I customers. This is a disincentive for undertaking infrastructure projects unless they can justify the inclusion of storage. This is an issue that needs to be prioritised and will need some regulatory intervention, or it will add to the network stress from demand growth.

The recent rollouts of large-scale energy storage projects is one of the key bright spots with our energy system. We have seen several utility scale new infrastructure projects incorporating battery storage, whilst also seeing existing infrastructure from decommissioned coal fired generation utilised for storage to take advantage of existing connections to the transmission grids. This will assist in taking some pressure off the demand growth in existing population centres.

The Government has also released a number of incentives (and policy measures) to establish manufacturing hubs in regional areas where they can be co-located with new generation infrastructure. This will also come with a new set of issues to be resolved such as meeting the workforce requirements and forcing alignment of existing incentives to ensure that these hubs can attain the intended objectives.

ADDRESSING CRITICAL UNCERTAINTIES TO BALANCE THE WORLD ENERGY TRILEMMA

Australia does not face a problem with energy resource security. It is a major exporter of both coal and gas, holds about one-third of the world’s uranium reserves, and benefits from significant solar and wind resources, along with a vast land footprint suitable for large-scale renewable energy development. The real challenge lies in building the transmission infrastructure necessary to deliver energy to coastal demand centres. Australia’s Energy Regulator has identified the need for an additional 10,000 km of grid infrastructure to support this transition.

The cost of new infrastructure, combined with additional expenses associated with renewable energy deployment, is viewed as a major concern, directly affecting the acceptance of large-scale renewable projects and the affordability of electricity for consumers. With a Federal Election approaching, cost of living remains a key topic of debate, especially as energy costs are forecast to increase by 10% over the coming year.

Energy affordability is a significant concern in Australia, particularly for low-income households. Although government rebates and concessions offer some relief, affordability challenges persist. Businesses echo similar concerns, particularly during periods of high wholesale energy prices and rising network costs.

Downloads

Australia Energy Issues Monitor 2025 Country Commentary

Download PDF