Middle East & Gulf States Network

The Middle East and Gulf States region includes major energy producers but also some of the fastest-growing energy consuming countries. The diverse regional community provides national Member Committees and their members with opportunities to expand and deepen their network and engage around activities and events – from young energy professionals to CEO and Ministerial level – on topics of interest to the members.

Regional action priorities that support the Council’s mission and humanising energy vision are agreed on an annual basis by national Member Committees in the framework of a Regional Action Plan. In 2021, key topics of interest to members in the region included the future of hydrogen in the region, the development of a circular carbon economy framework as a comprehensive approach in utilising all available levers for emissions reduction, and conversation about inspirational projects for sustainable energy.

Each month, the Middle East regional network meets to discuss matters of mutual interest, drive collective activities, and keep each other updated on relevant developments and events.

As part of World Energy Week LIVE 2021, a conversation focusing on Circular carbon economy in the Middle East was convened. Participants discussed, how currently mature solutions to address climate change such as energy efficiency and renewable energy are necessary but not be enough to achieve the goals set in the Paris Agreement. They highlighted that in the Middle East and Gulf States, there is a need to develop and deploy technologies of varying maturity to address emissions reductions across multiple sectors. Participants debated how a circular carbon economy framework may provide a comprehensive approach in utilising all available levers for emissions reduction and thereby. address the challenge of climate change while generating socio-economic value by creating valuable products from CO2.

Energy in the Middle East

INTRODUCTION

The Middle East and Gulf States are navigating an historic global moment – pivoting toward cleaner, low-emissions, and renewable energy sources, carriers and solutions and deepening regional collaborations on the Middle East Green Initiative.

While the region continues to play a dominant and stabilising role in global oil and gas markets, with fossil fuel revenues contributing more than 80% GDP in some Gulf States, governments and businesses are ramping up investments in hydrogen, large-scale renewables, and digital technologies.

Saudi Arabia is scaling giga-projects like NEOM and investing in hydrogen, while simultaneously expanding oil production capacity to strengthen its position in the global energy market. The NEOM project targets 4 GW of green hydrogen capacity, positioning the Kingdom as a future leader in clean fuels. At the same time, Saudi Arabia is targeting a 50% share of renewables in its power mix by 2030, rapidly scaling energy storage, and setting global benchmarks for low-cost solar and wind. Despite these efforts, rising domestic electricity demand, which is expected to grow 50% by 2040 in Saudi Arabia, poses a challenge for balancing economic growth and sustainability.

The UAE leads in renewable deployment, with major solar projects, nuclear energy, and a push for green hydrogen, aiming for a diversified post-oil economy. The UAE is targeting 50% renewable power by 2050. Additionally, subsidy reforms, such as UAE’s gasoline deregulation, highlight evolving government approaches that may impact affordability for residents.

Qatar is investing in district cooling systems to reduce energy use by 40%. It also remains focused on LNG expansion, reinforcing its role as a top gas exporter while exploring carbon capture and renewables.

Other Gulf states – like Kuwait, Oman, and Bahrain – balance fossil fuel reliance with gradual clean energy adoption, driven by economic diversification goals and regional climate commitments. Grid modernization and water-energy nexus solutions are emerging priorities.

Despite economic challenges, Lebanon promotes small-scale solar plus battery, cutting diesel reliance.

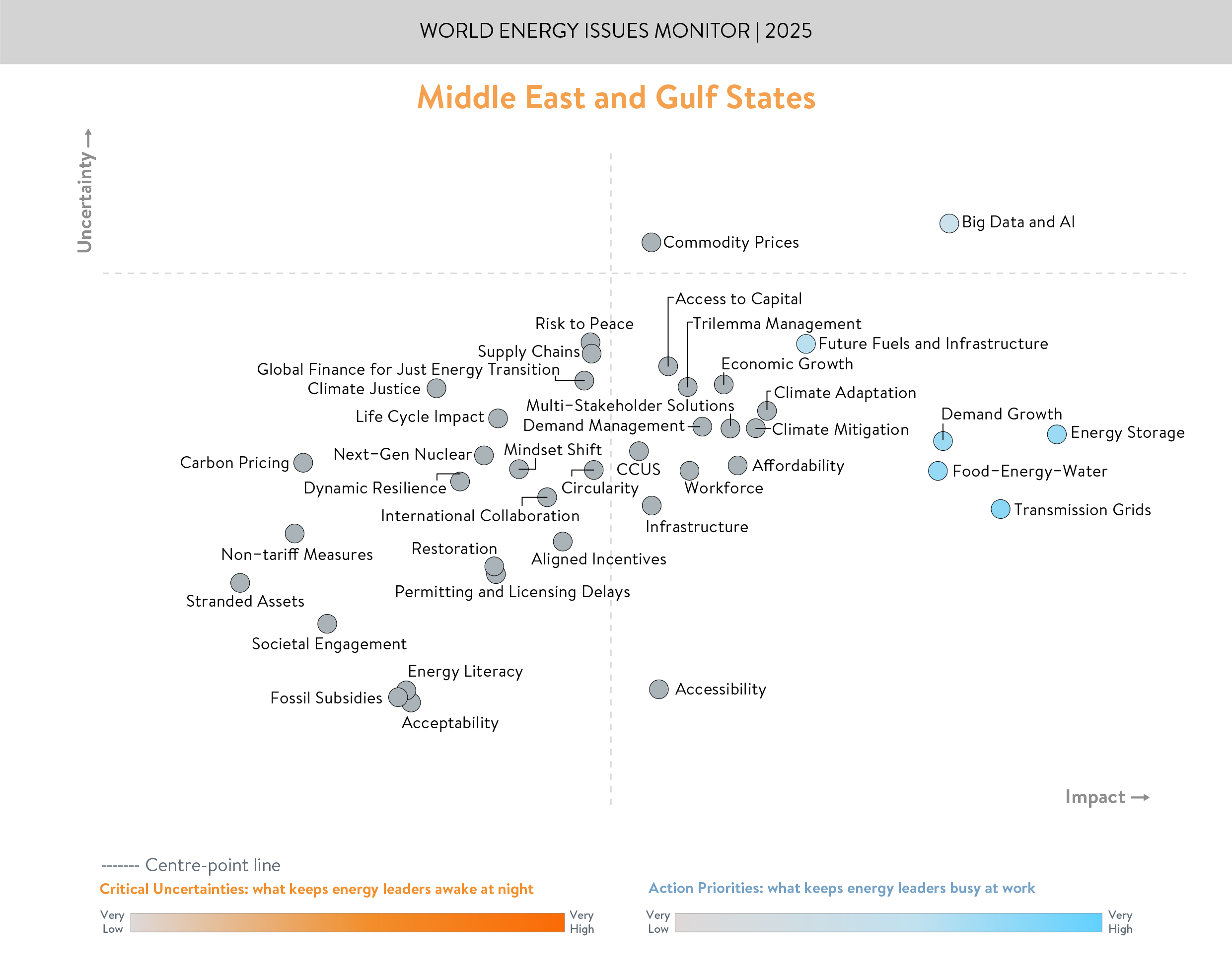

This evolving landscape is captured in the 2025 World Energy Issues Monitor, with energy security, accelerating demand, and the transformative impact of AI and big data emerging as key areas of focus. The rapid build-out of transmission infrastructure and regional interconnections reinforces the region’s strategic role in shaping global energy flows.

Alongside large scale renewable power systems, grid modernisation and CCUS technologies, circularity is emerging as a critical enabler of green economy models – helping economies do more with less by maximising the value of existing assets, reducing waste, and lowering lifecycle emissions. While Saudi Arabia's Circular Carbon Economy (CCE) framework exemplifies this direction, broader regional uptake remains uneven.

Yet, the path forward is not without challenges. Balancing economic resilience with environmental commitments, while navigating volatile trade dynamics, will require coordinated regional strategies. Success will hinge on the region’s ability to leverage its energy strength, attract investment, and align with global transition goals.

|

ABOUT THE WORLD ENERGY ISSUES MONITOR Energy transitions are complex, evolving, and deeply interconnected, shaped by shifting priorities, emerging uncertainties, and regional realities. Since 2009, the World Energy Issues Monitor has offered a unique lens into the dynamic forces driving energy transitions worldwide. This year’s survey spans 39 core transition issues across six categories – spotlighting blind spots, new signals, and shifting leadership priorities. Amid growing uncertainty, leaders across the World Energy Council community are asking sharper questions: What’s working? What can be adapted across regions? And where are the real opportunities to turn blind spots into bright spots?

NOTE ON TIMING AND CONTEXT The world Energy Issues Monitor was conducted between 24 November 2024 and 10 January 2025. The regional workshops that informed the commentary insights took place in the second half of February 2025, before the current trade tensions and the US-led trade tariffs. As such, the regional commentaries should be read in the context in which they were developed, prior to the escalation of current global trade dynamics. |

CRITICAL UNCERTAINTIES AND ACTION PRIORITIES

Top Critical Uncertainty: Big Data & Artificial Intelligence (AI)

Although the region exhibits moderate uncertainty overall, the transformative but not fully charted potential and impact of AI and Big Data are emerging as high-impact unknown.

-

Mega-Projects & Digital Transformation: Projects like Saudi Arabia’s NEOM and the UAE’s AIQ illustrate the promise of real-time analytics and advanced energy management. However, workforce shortages, uneven cybersecurity frameworks, and the lack of harmonised data policies raise questions about scalability. While AI strategies are ambitious (e.g. Saudi Vision 2030 and UAE’s AI Strategy 2031), digital transformation risks outpacing both talent pipelines and regional coordination.

-

Data Centre Surge & Reliable Power: Many countries seek to host global cloud hubs, driving up electricity loads from data centres. Leaders aim to power expansions with low-carbon sources – mainly solar – to sustain environmental goals. Yet stable power supply and advanced connectivity remain challenging for smaller or resource-constrained nations.

|

Energy-Cyber Nexus - AI and the Digital Infrastructure Boom in the Middle East & Gulf States

|

Top Action Priority: Transmission Grids

Transmission grid upgrades are a top-priority, low-uncertainty area — essential for scaling renewables and supporting the region’s growing industrial base.

-

Large-Scale Renewables: The region aims to scale up wind and solar capacity, and stable high-voltage networks are critical to integrating intermittent power. Projects like the Saudi Arabia’s wind-solar substantial expansions and UAE’s Mohammed bin Rashid Al Maktoum Solar Park depend on robust grids to avoid curtailment.

-

Regional Interconnectors: The region has been active in interlinking national grids, allowing electricity trading and improving reliability. The digitalisation of grids — through sensors, forecasting, and automation — aligns with the region’s AI ambitions, boosting flexibility and cost efficiency.

BLIND SPOTS AND BRIGHT SPOTS

Energy transitions in this historically hydrocarbon-dependent region are enabling some economies to pivot toward cleaner technologies; however, broader diversification and integration efforts are underdeveloped in others. Ambitious AI agendas coexist with smaller-scale projects that struggle with approvals. The 2025 data reveals:

Blind Spots

-

Mid-Scale Permitting Processes

While large, national-level energy initiatives often advance rapidly with high-level approvals, smaller or more regionally dispersed projects may experience longer timelines for licensing. Divergent administrative procedures across countries can slow progress on solar and interconnection developments.

-

Data Requirements for AI and Grid Modernisation

Digitalisation is underway, but inconsistent data collection still hampers advanced analytics. The UAE’s “EARTH” platform – focused on Economy, Adaptation, Reduction, Transition, and Health – is a promising step toward integrated policy, investment, and circular economy goals. Looking ahead, the plan is to include all relevant government entities. This further aligns policy, investments, and circular economy goals as the region accelerates toward sustainability targets.

-

Access to Capital Among Mid-Tier Economies

Well-funded nations are advancing major renewables and hydrogen projects. In contrast, smaller or mid-tier economies face higher borrowing costs and capital constraints, limiting their transition pace and scale.

Bright Spots

-

Renewable and Storage Acceleration

Saudi Arabia has committed to achieving a 50% share of renewables in its power mix. To date, it has tendered 44.1 GW of renewable projects and plans to tender an additional 20 GW annually, aiming to reach 130 GW by 2030, subject to demand growth. To support this transition, the Kingdom is rapidly scaling up energy storage, with 30 GWh of Battery Energy Storage Systems (BESS) either tendered or under construction as of April 2024, including 2 GWh already connected to the grid, and a target of 48 GWh by 2030. Saudi Arabia has also set global benchmarks for low-cost renewables, achieving record-low Levelized Costs of Electricity (LCOE) of 1.04 cents/kWh for solar and 1.57 cents/kWh for wind.

-

Regional Collaboration on Infrastructure

The Gulf Cooperation Council Interconnection Authority (GCCIA) has established a platform to facilitate regional electricity trading among GCC countries. Saudi Arabia is advancing interconnection projects with Egypt, Iraq, Jordan, India, and Greece, aiming to deliver reliable, affordable, and sustainable electricity while enhancing the resilience and efficiency of the interconnected grids. In parallel, efforts to upskill and reskill the regional workforce are underway to keep pace with evolving technological demands.

-

Energy Efficiency for Demand Growth

Economic expansion and industrial growth are steadily increasing electricity demand across the region. In response, countries are boosting energy efficiency through programmes like the UAE’s 2050 Water and Energy Demand Management Strategy, which targets a 40% improvement across key sectors. Initiatives such as the Global Energy Efficiency Alliance (GEEA) highlight the region’s push for faster efficiency gains and stronger international collaboration.

-

Leading Hydrogen Investments

Saudi Arabia, the UAE, and Oman have launched multibillion-dollar green and blue hydrogen projects. These initiatives leverage existing energy know-how, abundant sunshine for solar-driven electrolysis, and cost-competitive natural gas (with carbon capture for blue hydrogen). Saudi Arabia’s early exports of clean ammonia, beginning in 2020, signalled the region’s proactive role in clean energy trade and hydrogen development.

-

Lebanon’s Microgrid & Renewables Uptake

Despite economic challenges, Lebanon promotes small-scale solar plus battery, cutting diesel reliance. Renewables now supply over 25% of national electricity generation, showing smaller nations’ advancements with decentralised installations.

|

Key Implications for Humanising Energy – Middle East & Gulf States

|

CONCLUSION

Like the shifting formations of a migrating flock, energy transitions in the Middle East and Gulf States show both direction and divergence — anchored by hydrocarbon legacies yet propelled by digital ambition and renewable mega-projects. This interplay of established resource wealth with evolving ambitions in renewables and AI confirms several key takeaways:

-

Big Data & AI stand out as the region’s principal unknown, reflecting confidence in rapid technology deployment yet underscoring the complexities of aligning digital innovations with energy infrastructure, skilled workforces, and robust data governance.

-

Transmission Grids remain a top priority, as scaling major solar and interconnection projects demands reliable, future-focused grids. Ambitious hydrogen mega-projects and advanced analytics hinge on secure, high-capacity networks across national borders.

-

Blind spots – including mid-scale permitting, data readiness, and localised capital constraints – risk slowing the shift away from purely fossil-based economies. If unaddressed, these subtle frictions may undermine even large government-backed initiatives.

-

Bright spots include swift policy execution on mega-solar and hydrogen, strong inter-Gulf grid ties, growing energy efficiency frameworks, and microgrid projects in Lebanon that cut diesel reliance. Such advancements showcase how diversified investment and local capacity-building can accelerate transformations.

By celebrating these regional nuances and accelerating peer learning, the Middle East and Gulf States can leverage its unique strengths – from abundant solar potential to AI-driven operations – and shape a resilient, inclusive future in the ever-evolving global energy landscape.

KEY CONTRIBUTORS

In addition to thanking experts from across our community for their contributions, we would like to make special mention of Dr. Axel Pierru, Vice President, Knowledge and Analysis at KAPSARC; Pierre El Khoury, Senior Energy Advisor, Secretary of the Lebanon Member Committee, World Energy Council; Nawal Yousif Ibrahim Al-Hanaee, Director of Future Energy Department, Ministry of Energy and Infrastructure, United Arab Emirates; and Haider Alabdulaal, Policies & Strategic Planning Consultant, Ministry of Energy, Kingdom of Saudi Arabia.

Downloads

World Energy Issues Monitor 2025

Download PDF