The BusinessNZ Energy Council (the ‘BEC’) is a multi-sectoral group of New Zealand business, government and academic organisations taking on a leading role in creating a sustainable energy future for New Zealand. Since 1 January 2013, the BusinessNZ Energy Council brings together the memberships of BusinessNZ and the former Energy Federation of New Zealand. The BEC shares energy information, represents the views of its members, promotes dialogue and networking for its members, prepares and disseminates reports and organises seminars and conferences. Its goal is to “support New Zealand’s economic well-being through the active promotion of the sustainable development and use of energy, both domestically and globally.”

Greg was previously CEO of the Beca Group from 2012-2023, one of largest privately owned professional services consultancies in the Asia-Pacific region with 4000 staff based in eight countries. Greg provided strategic leadership to all operating geographies as they delivered client projects in typically 45 countries every year. An employee-owned business, Beca is a NZ headquartered multinational that has delivered innovation for its clients for more than 100 years. As Managing Director for Beca Australia from 2006-2012, Greg oversaw the delivery of the $4B Victorian Desalination project, Beca’s largest design commission and which delivers around one third of Melbourne's water supply.

Greg previously held senior management roles in asset management and information technology consultancies. His early career with the NZ Navy culminated in senior roles covering operations, policy and major project delivery. Greg is an Officer of the NZ Order of Merit, a Fellow of Engineering New Zealand, a Chartered Member of the Institute of Directors in New Zealand and holds a Masters degree in Engineering and a First Class Honours degree in Mechanical Engineering from the University of Auckland.

Greg is also the NZ Co-Chair of the Australia-New Zealand Leadership Forum and Chair of the NZ Defence Industry Advisory Council and now Chair of the BusinessNZ Energy Council.

Tina is the Executive Director – Energy and Innovation at BusinessNZ. She leads and manages the BusinessNZ Energy Council (BEC) and is responsible for the development of Business New Zealand policy on all matters relating to energy, transport and innovation. Her work also includes the World Energy Council's Energy Trilemma Framework, Energy Issue Maps and Energy Innovation Framework as well as the content development and organisation of the Asia-Pacific Energy Leaders’ Summit (2016 and 2018) and involvement in the cross-sector BEC Energy Scenarios Projects.

Her fields of specialisation include the energy industry, energy technology, energy policy and marketing.

Prior to her role as Executive Director, she worked as the Senior Policy Advisor for Energy and Innovation at BEC. Tina also worked for enviaM in Germany, a subsidiary of RWE AG, where she was responsible for the purchasing and distribution of electricity and gas. From 2012-2013, she worked in marketing and distribution for STI Solar Technologie International GmbH, Germany. While there, she was responsible for rolling out new products across Europe.

Tina holds a Master of Science (M.Sc.) Value Chain Management from the University of Technology, Chemnitz in Germany and a Bachelor of Arts (B.A.) Management of Energy Utilities from the University of Applied Sciences, Zwickau in Germany, including a semester at the University of Borås in Sweden studying International Marketing and Strategic Marketing.

Energy in New Zealand

ENERGY ISSUES IN MOTION

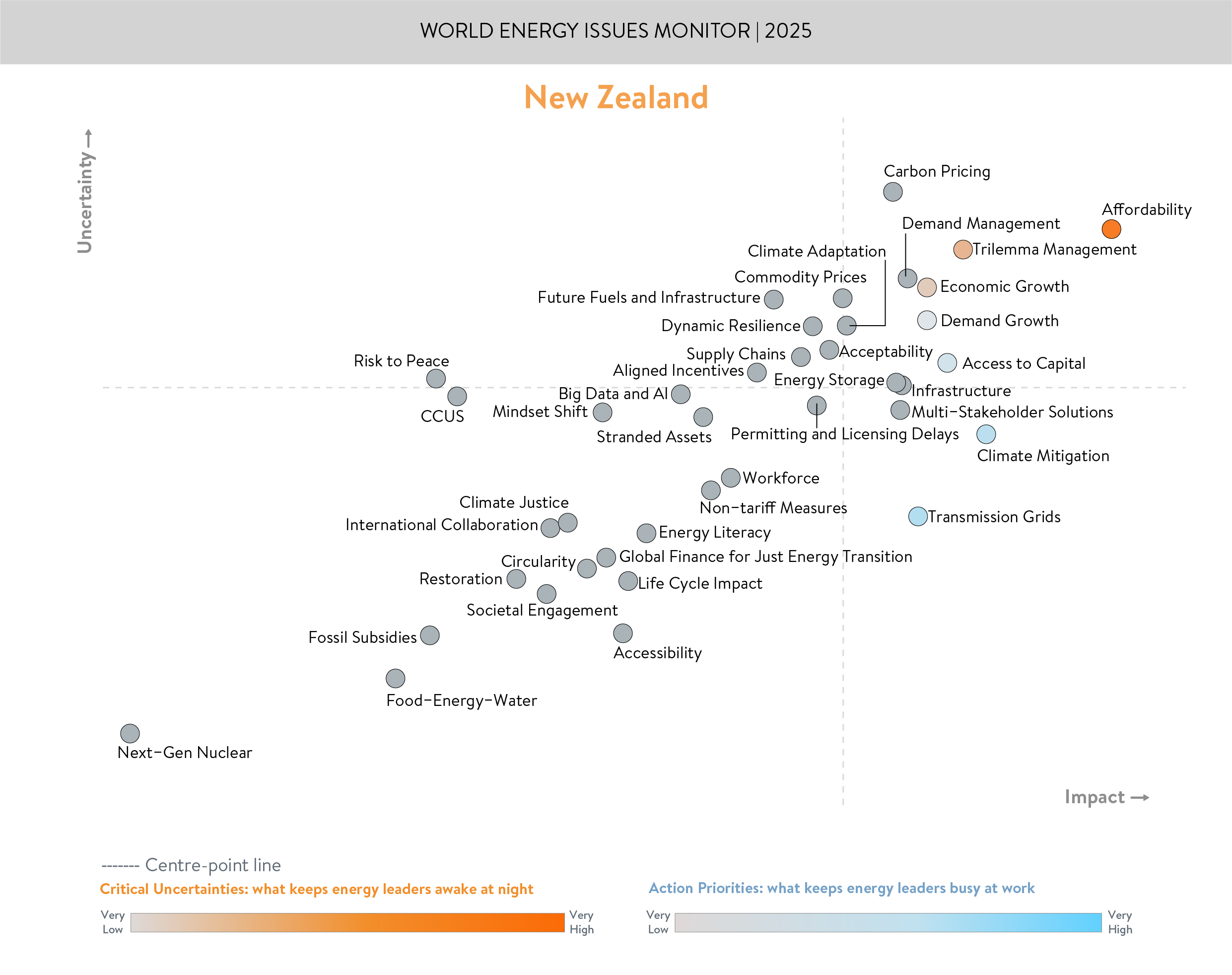

In 2025, affordability has emerged as the top critical uncertainty in New Zealand’s energy landscape, overtaking infrastructure concerns that were a primary focus in 2024. Low hydro levels and a diminishing gas supply have placed significant pressure on energy costs, with affordability now seen as having the highest degree of impact despite ranking below carbon pricing in terms of outcome uncertainty. Carbon prices in New Zealand have been bumpy over the last few years due to a combination of factors. The Emissions Trading Scheme (ETS) is the primary mechanism in NZ for cardon pricing, but government interventions have created instability. This combined with an oversupply of New Zealand Units (NZUs) and investor hesitation has made carbon price movements in NZ unpredictable leading to the uncertainty shown in the country’s issues map. As New Zealand continues its decarbonisation efforts, the carbon price is an important component driving the countries efforts towards net-carbon-zero by 2025.

New Zealand aims to achieve net-carbon-zero by 2050. Initially, gas will be used to ensure security during peak usage periods while increasing the share of intermittent renewable electricity generation. However, unexpected declines in gas field production, capital flight, and sovereignty risk created by uncertain government positions have compromised this role. In dry years, gas can no longer adequately fill the gaps in electricity demand, exacerbating supply uncertainties and driving up spot prices for large consumers. This subsequently intensifies the challenge of affordability, especially for industrial users who are increasingly subject to fluctuating costs. While grid-scale storage and demand response growth could mitigate supply risks during dry years and increasing intermittent electricity supply, industrial gas users will continue to face challenges in finding alternative supply. Significant investment is required, and in the short term, energy prices remain vulnerable to upward pressures. Due to these challenges, energy-intensive industries such as manufacturing and agriculture may face production constraints, impacting economic growth and competitiveness within commodity markets.

Since the 2024 iteration of the World Energy Issues Monitor, infrastructure concerns have diminished in uncertainty but remain a high-priority action item alongside transmission grids. The coalition government's 2024 budget allocated a significant portion of funding toward addressing New Zealand’s infrastructure deficit, likely contributing to the decreased uncertainty. However, the trilemma management has become an area of growing concern, increasing in both uncertainty and priority of action. This shift is closely tied to affordability issues, as rising costs impact energy equity, while concerns over reliable gas access also contribute to heightened security risks. With limited gas supplies, the energy sector urgently needs alternative secure, affordable, and sustainable solutions. Meanwhile, demand management remains a pressing issue in 2025, with looming gas shortfalls raising the prospect of large industrial users having to limit production to reduce overall demand.

FROM BLIND SPOTS TO BRIGHT SPOTS

One of the key blind spots in New Zealand’s energy landscape continues to be community engagement. Societal engagement and energy literacy rank low on the country’s issues map for perceived uncertainty and impact, yet these factors are crucial in ensuring public support for energy initiatives. The World Energy Council (WEC) has highlighted that neglecting local sentiments can stall or derail projects, reinforcing the need to ‘humanize energy’ and better align political will with citizen needs. Addressing this blind spot requires a sustained effort to improve communication between suppliers and consumers, fostering a two-way dialogue that ensures energy policies reflect diverse needs and perspectives.

Public by-in and support for energy infrastructure projects can be greatly improved through projects like Denmark’s community wind farm ownership models. This joint ownership not only helped finance but actively encourage development. Within New Zealand there are more than 260 small scale community energy projects1 like this beginning to take place with Energise Ōtaki being a good example.

While affordability has dominated the conversation in this year’s data, it is important to recognise that other issues have not been overlooked. The spread of concerns across various dimensions is reflected in the clustering of issues around the centre-point line on New Zealand’s Issues Map, indicating a broad awareness of multiple challenges within the energy sector.

Despite the challenges facing its energy sector, New Zealand continues to be an early mover and innovator. The country’s abundant renewable energy resources position it well for ongoing transition efforts, and the combined efforts of private and public enterprises have helped leverage diverse stakeholders to tackle emerging challenges. While concerns persist regarding gas sector shortfalls, rising peak electricity demand, and blackout risks, demonstrated in 2024, New Zealand remains resilient. It ranks among the top ten countries in balancing the energy trilemma, a testament to its strong regulatory framework and adaptability in the face of evolving energy needs.

ADDRESSING CRITICAL UNCERTAINTIES TO BALANCE THE ENERGY TRILEMMA

Affordability remains the dominant uncertainty impacting New Zealand’s energy trilemma, as rising prices threaten energy equity and make it increasingly difficult for households and businesses to manage costs. This growing concern over affordability aligns with the increased uncertainty surrounding trilemma management, now one of the top critical uncertainties reflected in the 2025 Issues Map.

Alongside affordability, two key action priorities, climate mitigation and transmission grids, underscore the importance of sustainability and security. Strengthening New Zealand’s transmission grid is essential to meeting future energy demands. As the country progresses toward its goal of net-zero emissions by 2050, electricity demand will continue to rise, necessitating robust infrastructure to ensure efficient energy delivery from generation to end users. In the long term renewed investment into supply sources such as geothermal, wind and solar, combined with improved storage and grid efficiency will help address challenges. These will take time to implement to a degree great enough to fill the gaps and so in the short-term demand-response measures and incentivising industrial flexibility will be critical steps in ensuring grid stability. Addressing these priorities will be vital in maintaining a balanced and resilient energy system for New Zealand’s future.

Acknowledgements

New Zealand Member Committee

Downloads

New Zealand World Energy Issues Monitor 2025 Country Commentary

Download PDF

New Zealand World Energy Trilemma Country Profile 2024

Download PDF

New Zealand Energy Issues Monitor 2024

Download PDF

World Energy Issues Monitor 2024

Download PDF