The Energy Council of South Africa is a CEO-led initiative that brings together key public and private sector companies, business/industry associations and finance institutions that have a significant presence and actively participate in the energy sector.

ENERGY IN SOUTH AFRICA

Energy Issues in Motion

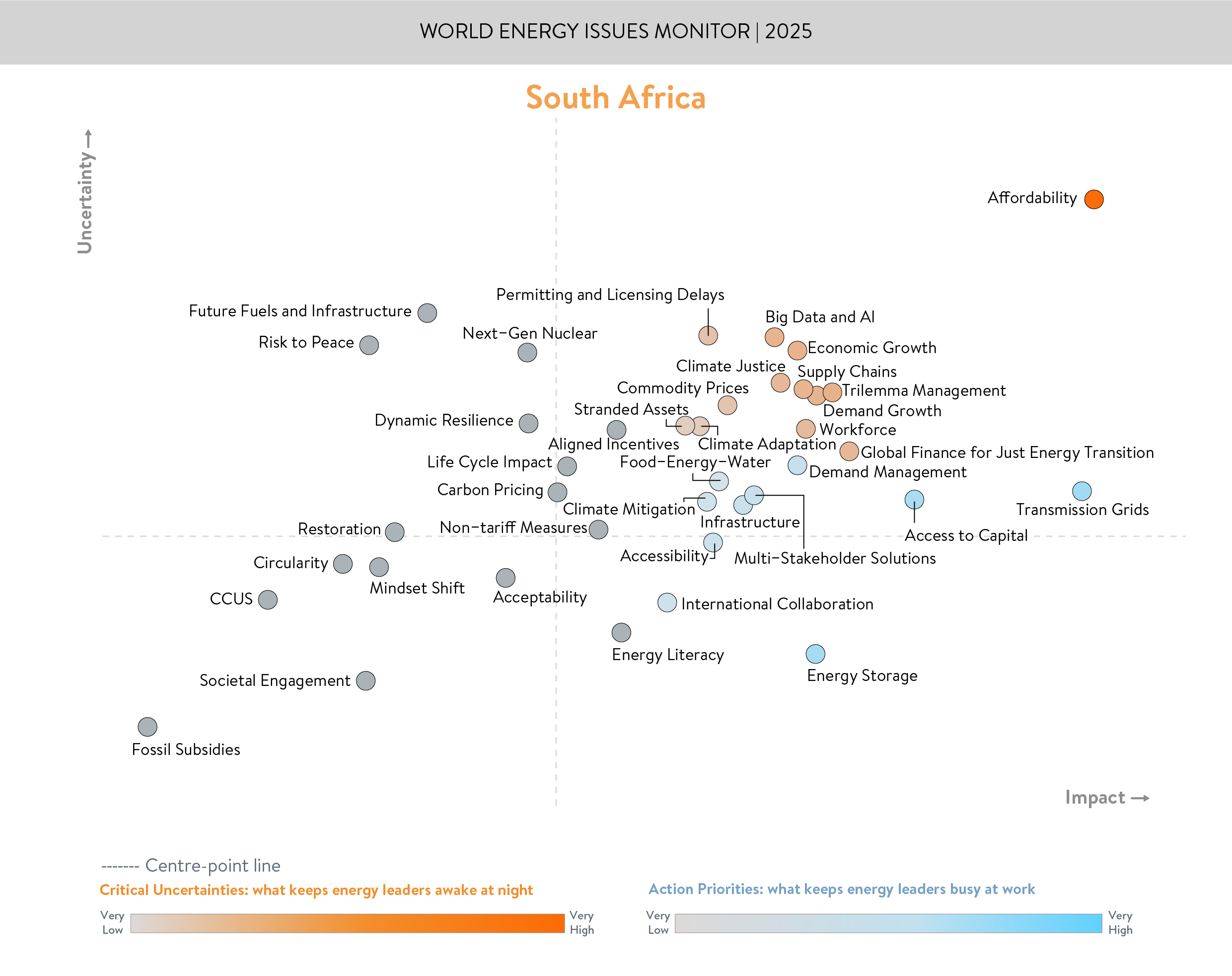

Since the last World Energy Issues Monitor iteration, South Africa’s energy sector has undergone rapid and fundamental shifts that critically influence the prioritisation of our core energy transition issues. Most notable shifts include the structural end to loadshedding, the creation of a dedicated Ministry of Energy and the promulgation of key legislation, such as the amendments of the Electricity Regulation Act and Climate Change Act. The 2025 World Energy Issues Survey results for South Africa highlights key shifts in energy concerns compared to previous years. Brief analysis of the most critical uncertainties and action priorities in the 2025 map are highlighted below.

Key Critical Uncertainties

The key critical uncertainties that stakeholders must address through strategic engagement include the following complex issues:

- Global Finance for Just Energy Transition – Securing international funding remains unpredictable, affecting South Africa’s ability to advance its energy transition and meet decarbonisation goals.

- Big Data & AI – The evolving role of digital technologies in energy management is causing uncertainty, particularly regarding regulation, cybersecurity, and efficiency gains.

- Climate Justice – Social and economic dimensions of climate policies remain uncertain, affecting equitable transition strategies and public support.

- Permitting & Licensing Delays – Regulatory streamlining is necessary to accelerate project implementation and reduce bureaucratic bottlenecks.

- Economic growth – South Africa's economic growth in recent times has been relatively muted, with GDP growth of 0.6% in 2024, the slowest since 2020. The global economic slowdown and the national growth outlook does not bode well with the energy transition ambitions as it reduces opportunities in emerging industries like renewables.

Key Action Priorities

These areas require immediate focus for policy refinement and infrastructure investment:

- Demand-Side Management & Efficiency – South Africa requires urgent attention to implement smart-grid technologies for better load balancing and demand forecasting. This should be complemented by consumer awareness and incentives for energy conservation in light of the recent energy crisis. Furthermore, it is imperative to promote energy efficiency programs within industries, businesses, and households.

- Energy Storage – A strong focus on storage solutions indicates that stakeholders see this as a necessary step for stabilising renewable energy integration.

- Grid Modernisation & Investment – As in previous years, South Africa continues prioritising improvements to transmission infrastructure to improving reliability and integrating renewable energy.

- Multi-Stakeholder Solutions & Infrastructure Development – Collaboration across government, industry, and investors is essential for financing and executing energy projects.

From Blind Spots to Bright Spots

The 2025 South Africa WEIM survey revealed that energy literacy, societal engagement accessibility and acceptability are blind spots that are not receiving the attention they deserve. Amongst the geopolitical issues, international collaboration is a blind spot for our country. Outlook for multilateralism, shifts in alliances, global energy governance challenges, and new models of public-private partnerships will shape South Africa’s transition going forward.

Energy literacy is crucial for a just energy transition, impacting individuals significantly. It involves understanding energy's role in daily life and applying this knowledge to engage with energy policies. Despite its importance, most governments often overlook this. In 2024, the Energy Council of South Africa developed the #EnergiseMzansi Communication Campaign, launched in February 2025. This campaign aims to enhance energy transition literacy in South Africa by providing fact-based, simplified information. It addresses six key themes to foster awareness, understanding, and meaningful debate about energy issues, including the need for market reform and viewing energy as an integrated system.

Acknowledgments

South Africa Member Committee

Downloads

South Africa World Energy Issues Monitor Country Profile 2025

Download PDF

World Energy Issues Monitor 2025

Download PDF

South Africa World Energy Trilemma Country Profile 2024

Download PDF

World Energy Trilemma Report 2024

Download PDF

South Africa World Energy Issues Monitor 2024

Download PDF