The Austrian Member Committee of the World Energy Council represents Austria within the international organisation of the World Energy Council. Members of the Austrian Committee include the Austrian Federation, represented by ministries, universities, and companies of the Austrian energy sector. This membership is defined by the general convention after an application for entry of the candidates.

Mag. Dr. Michael STRUGL MBA is the Deputy Chairman of the Managing Board of VERBUND AG, Austria´s leading electricity company and one of the largest electricity generators from hydro power in Europe, since January 2019. His department includes energy economy and business management, strategic human resources management, corporate innovation and new business, marketing and communication as well as the operative divisions trading and sales. Additionally, Dr. Strugl holds the position of President of Austria´s energy industry representative body, Austria´s Energy (Oesterreichs Energie) since June 2020 as well as the position of President of the World Energy Council Austria since October 2020.

Dipl.-Ing. Mag. Gerhard Gamperl

Energy in Austria

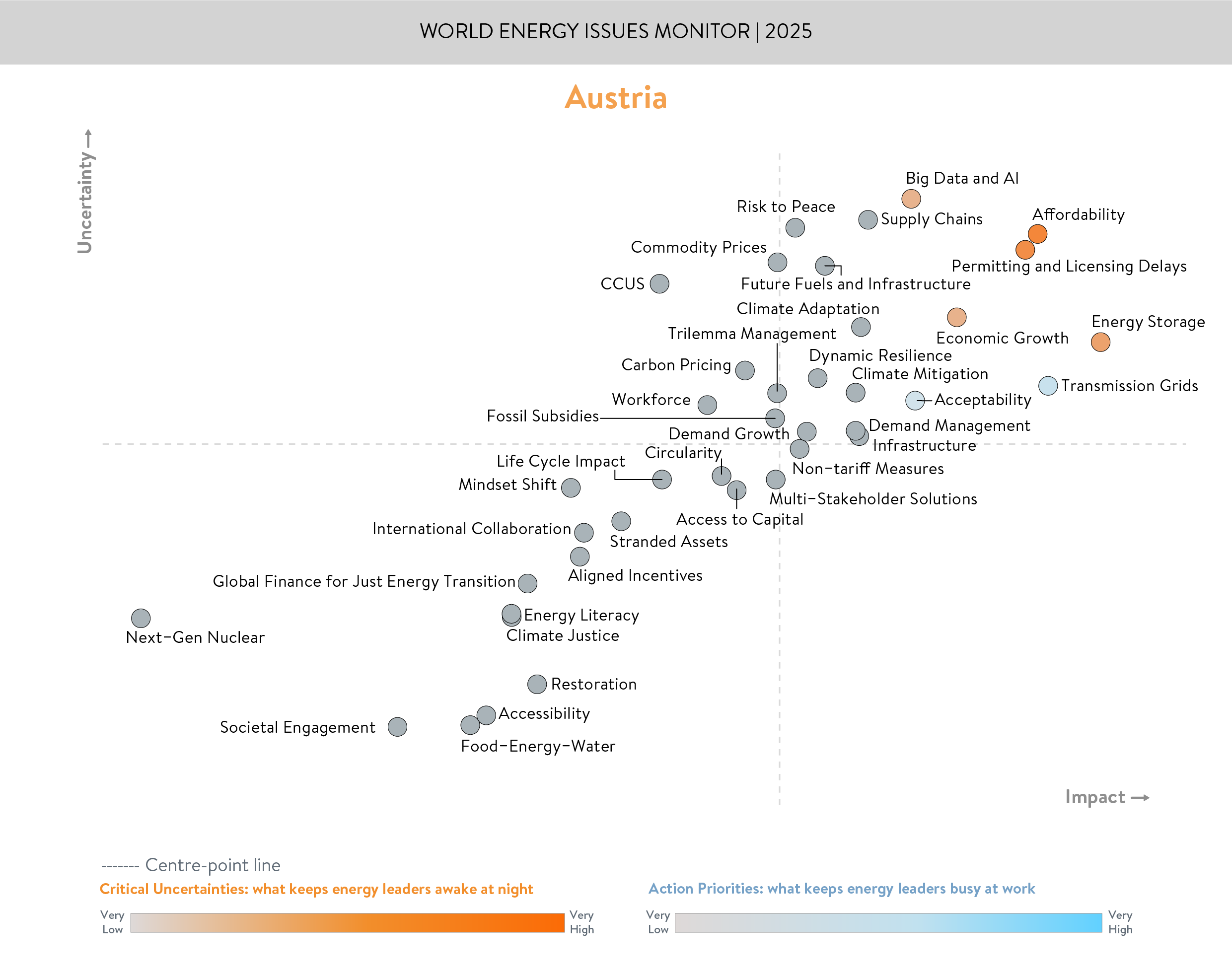

Austria's energy landscape is shaped by the ongoing push towards environmental sustainability, and the necessity of maintaining a secure and affordable energy supply. The World Energy Issues Monitor 2025 highlights key challenges and priorities for Austrian energy leaders. The report identifies affordability, permitting & licensing delays, and supply chains as the three top priorities. Also, the adoption and usage of AI & Big Data technologies, as well as the integration of energy storage solutions and grid modernisation & extension are considered as domains with a high degree of uncertainty, or potentially high impact, consequently manifesting action priorities. Compared to last year’s results and the European Union (EU) average, risk to peace, previously a dominant concern, is still perceived as a relevant uncertainty but has declined in relative importance last year. However, in 2025 risk to peace might be gaining relevance again, considering recent global developments.

Affordability

Energy affordability remains a pressing concern in Austria and in Europe. While peak load is predominantly provided by gas-fired power plants, gas prices predominantly set the electricity price on the merit-order, in times of low renewables generation. By January 1st 2025, supply contracts for significant quantities of Russian gas have been terminated, while gas supply was redirected and diversified with increased quantities imported via German and Italian corridors. Austria's gas supply is mainly secured through Over-the-Counter contracts with intermediaries, making it impossible to trace the origin of the commodity. The same applies to gas procured via power exchanges. However, general scarcity in the market increased the gas prices over the last years, eventually also leading to higher electricity prices. Furthermore, the ongoing rollout of non-dispatchable energy sources such as wind and solar is outpacing the increased need for grid and storage expansion. Occasional price peaks have been observed throughout the year, particularly during periods of low wind and solar generation (so-called Dunkelflaute) and when supply was locally constrained by grid capacity limitations. While these events are limited in its frequency, they pose a significant uncertainty for investment decisions for energy intensive industries. In Austria and Europe alike, electricity prices are significantly and structurally higher compared to US and Asia averages, posing challenges for domestic industry and competitiveness.

Permitting & Licensing Delays

Bureaucratic hurdles in permitting & licensing cause significant delays in the grid integration of renewable energy in Austria. With wind power approval procedures averaging around three years, or the prominent 77-month approval procedure for the 380-kV-Salzburgleitung, a much-needed transmission grid extension to connect pumped hydropower storage in the west with renewables capacity in the east of Austria, are just few examples of the high burdens for project developers. While leading utilities are confident that Austria will reach its renewable energy deployment target to reach 100% renewable electricity (on a national balance) by 2030, permitting and licensing is perceived as the major obstacle on this road. Addressing these inefficiencies through streamlined permitting frameworks and digitalization of procedural formalities would heavily support Austria’s ambitious climate targets.

Supply Chains

The energy sector is increasingly affected by supply chain disruptions. While gas supply and supply dependence became a painful reality after the beginning of Russia’s war against Ukraine, lately also materials and components for renewable energy technology experience certain aspects of supply chain distortion, whether it is price spikes (e.g. rare earths) or limited production capacities (e.g. transformers). Technology availability is heavily influencing the speed of the energy transition and can be crucial for complex endeavours such as the green hydrogen economy. Dependence on imported materials and manufactured goods, such as geographically highly concentrated rare earth elements and semiconductors, adds geopolitical risk, earlier just known from fossil fuels. As done with natural gas supply, Austria must also enhance its resilience by diversifying supply sources for raw materials and components, investing in local manufacturing, and fostering European and international partnerships for securing relevant resources.

Energy Storage & Transmission Grids

With Austria’s high share of renewable electricity, energy storage is essential for grid stability and optimized utilization of renewable energy capacity. While pumped hydro power is dominant in Austria and recent efforts to modernise the grid improved the accessibility to these capacities, grid scale battery storage solutions are still perceived as a much-needed addition to the Austrian energy landscape. Intermittency issues are costly and as already mentioned, a risk for industrial competitiveness. Renewables build-out must therefore be orchestrated with capacity build-out. For many utilities and financiers, battery storage systems are a very novel asset class with high complexity in terms of commercialization and risk management. Policymakers must address these issues by proactively shaping the regulatory framework for batteries. Expanding and modernizing transmission and distribution grids is a further key priority and much needed to support the integration of renewables and cross-border energy trading. Austria’s strategic position in Central Europe makes it an important hub for electricity flows between neighbouring countries. Investments in grid infrastructure and digitalization, but also regulatory optimization are necessary efforts to enhance efficiency, reduce congestion, and improve overall system resilience. AI & Big Data technologies can especially show their potentials related to grid integration of renewables and therefore drive grid operators into exploring new digital solutions.

Economic Growth

Austria’s economic outlook is closely tied to its energy policy, particularly as industrial output has slowed down in recent years. In 2023 Austria slided into a recession that worsened throughout 2024, eventually leading to one of the most negative growth rates in the EU-27. High energy prices continue to pose a competitiveness challenge for energy-intensive industries, such as steel manufacturing, chemicals and pulp and paper, sectors where Austria is home of several world champions. All these sectors experience growing pressure from international competitors operating with significantly lower costs, heavily influenced by energy prices. To safeguard economic stability while advancing the energy transition, Austria must focus on targeted support for industries, energy price stabilization measures, and enhanced grid infrastructure to improve efficiency and cost-effectiveness. A further aspect is research and innovation. Several Austrian research initiatives and pilot projects engage with industrial decarbonisation and competitiveness. Green hydrogen is an enabler for green steel production potentially cutting 5% of Austrias CO2 emissions, as one of the outstanding transition projects.

Acceptability

Public acceptance of renewable energy projects remains a critical challenge in Austria. A recent public vote in Carinthia to ban wind energy entirely in the federal state highlights the ongoing resistance to certain renewable developments – despite the country’s ambitious climate goals and potentials. Austria’s effort to progress with its energy transition is highly dependent on the individual ambitions of the nine federal states, with some states still having non or only few wind turbines under operation (Salzburg, Tyrol, Vorarlberg), and some states with strong renewable generation capacities and high ambitions (especially Lower Austria and Burgenland). Opposition is often driven by concerns over landscape aesthetics, environmental impacts, and local stakeholder interests. Such resistance underscores the need for better community engagement, transparent decision-making processes, and incentives that align local benefits with national and international energy objectives.

Acknowledgements

Austria Member Committee

Erich Eschrich

Gerhard Gamperl

Martin Heissenberger

Downloads

Austria World Energy Issues Monitor 2025 Country Commentary

Download PDF

World Energy Issues Monitor 2025

Download PDF

Austria World Energy Trilemma Country Profile 2024

Download PDF