The World Energy Council Romanian Member Committee is a non-governmental organisation and a founding member of the World Energy Council. It is also a strategic partner in Romania’s sustainable energy development programme. World Energy Council Romania offers useful and topical information for all forms of energy (coal, oil, gas, nuclear, hydro and renewable); has a steady communication strategy with its members, keeping them abreast with the latest energy policies; represents the interests of its members within the meetings and events organised by the World Energy Council; and contributes to decision making at worldwide level, with Romanian representatives in all of the World Energy Council’s Study Groups.

Stefan Gheorghe became Secretary of the Romanian Member Committee of World Energy Council in December 2017.

Mr. Gheorghe holds a Ph.D. in Power Engineering from "Politehnica" University of Bucharest (1994) and an MBA from OPEN University Business School – UK (2004). He has over thirty years of experience in the Romanian energy sector, in various positions of execution and top management of transmission, distribution, supply and generation of electricity.

He has also worked in various study committees and international working groups as a representative of the Romanian electricity distribution sector, as a member of CIGRE and EURELECTRIC, currently as a senior member of the world's largest organization of electrical and electronic engineers, IEEE - Institute of Electrical and Electronic Engineers (USA).

Mr. Gheorghe has a teaching career as a Professor in two Universities in Romania: “Valahia” University of Targoviste, at the Faculty of Electrical Engineering and "Politehnica" University of Bucharest at the Faculty of Power Engineering. He has also published nearly 100 scientific papers in the country and abroad, books, university courses and international energy reports in the field of energy.

Energy in Romania

ENERGY ISSUES IN MOTION

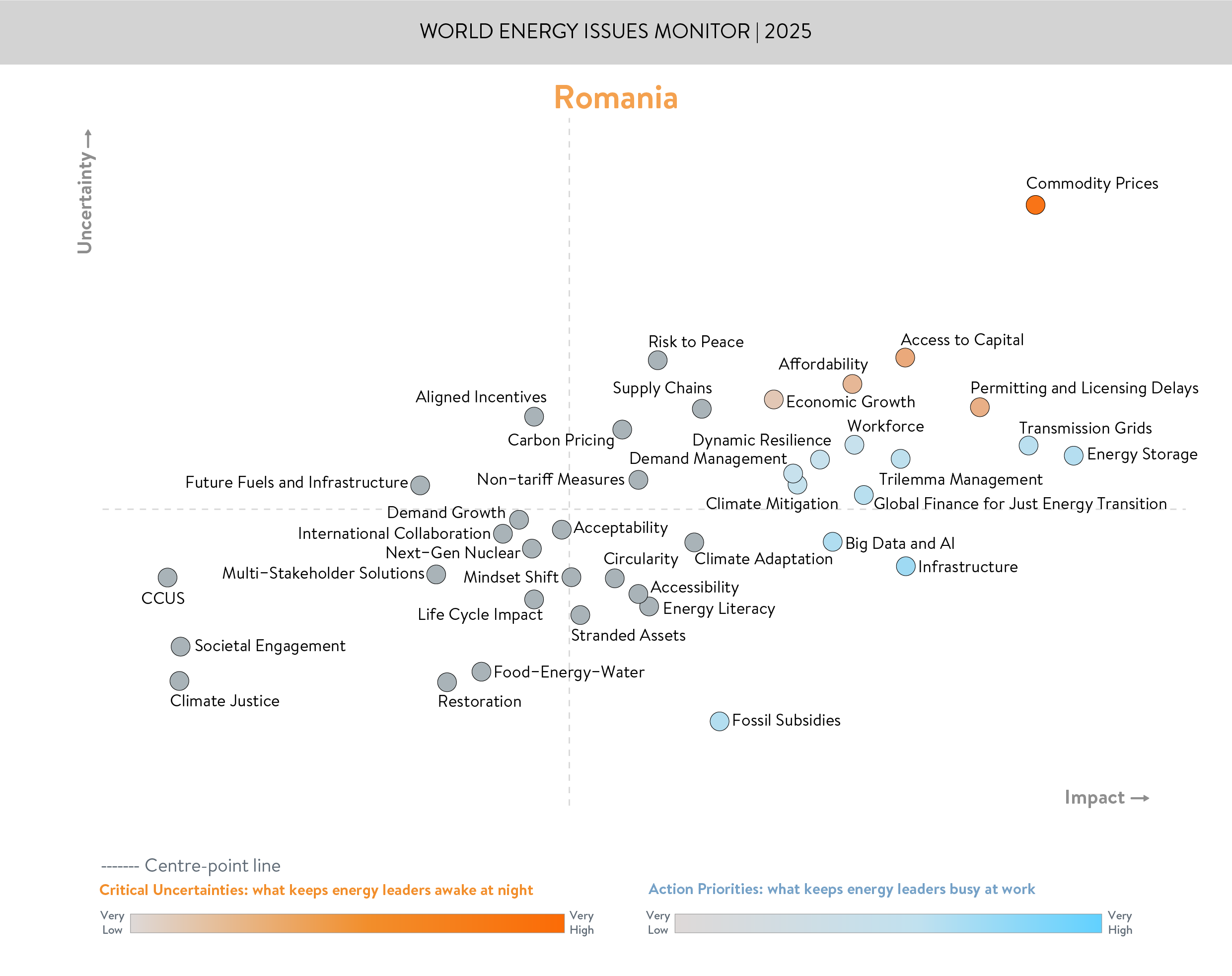

Romania’s energy sector continues its modernization journey while pursuing self-imposed transition targets. In this context, the country shares several critical uncertainties and action priorities with other European Union Member States.

Among these, commodity prices emerge as the dominant critical uncertainty, clearly standing out from other concerns and remaining a persistent challenge. Although Romanian consumers currently benefit from a price cap on both electricity and gas, Contracts for Difference (CfD) payments have been delayed, creating operational difficulties. Additionally, the cost of capital has increased, driven by heightened uncertainty due to the erosion of Romania’s credit rating and a consumer price index above the EU average. This financial pressure is closely linked to concerns about economic growth, which has been affected by regional instability and broader global disruptions.

Affordability also ranks as a key uncertainty. At the time of the survey, the government had not yet decided whether to extend the energy price cap into 2025. It has since announced an extension: the cap will remain in place until June 2025 for all households and until December 2025 for vulnerable consumers.

Compared to the previous year, Romanian energy leaders have identified a significant shift in their top concerns. In 2025, the critical uncertainties include commodity prices, access to capital, permitting and licensing delays, affordability, and economic growth. This contrasts sharply with 2024, when energy storage, infrastructure, workforce, and geopolitical risks dominated. Notably, energy storage, previously seen as a major uncertainty, is now considered an action priority. Romania has officially committed to deploying 1.2 GW of battery storage and 0.8 GW of hydro-pumped storage by 2030. Authorities are also rolling out funding schemes for both utility-scale and residential energy storage.

Despite nearly 57 GW of renewable energy projects under development, many companies face challenges in securing financing. Access to capital remains a major barrier, largely due to rising costs, Romania’s downgraded credit outlook (BBB- with a negative outlook), and weak market appetite for long-term power purchase agreements (PPAs). However, mechanisms such as the latest CfD scheme (targeting 5 GW of new renewables), the National Recovery and Resilience Plan, and Modernization Fund financing have started to unlock investment in new RES and battery projects. Still, banks are reluctant to fully finance merchant RES or battery ventures.

Although Romania boasts one of the shortest permitting and licensing procedures in the EU, projects still face delays. These are often due to environmental constraints, dependencies on grid reinforcement (which may take until 2030), and local-specific requirements—such as the obligation for projects exceeding 50 hectares to complete a Zoning Urban Plan, a requirement not previously enforced. Additionally, Romania must still designate its “go-to areas” for streamlined permitting.

Action priorities have also shifted. Issues such as risk to peace and workforce, previously seen as uncertainties, have now been elevated to action priorities. Carbon prices are a key concern, as electricity prices remain strongly influenced by coal-fired generation. Workforce challenges persist across the broader economy. Other longstanding priorities like supply chains and climate adaptation continue to feature at varying degrees of intensity over the past five years.

However, these energy transition efforts may face setbacks if the current conditions change. Among all concerns, access to capital stands out as the most sensitive—and potentially underestimated—uncertainty. If unresolved, it could deepen Romania’s economic difficulties and further constrain the energy sector, amplifying existing vulnerabilities.

FROM BLIND SPOTS TO BRIGHT SPOTS

A potential blind spot is emerging from the global context marked by rising commercial tensions, the unresolved Russia–Ukraine conflict, and increased defense spending needs. This situation overlays existing challenges, including a large budget deficit and the pressing need to develop the energy sector while advancing toward climate neutrality. A reduction in capital injection could slow down the transition and disrupt progress across the three dimensions of the World Energy Trilemma: security, sustainability, and affordability.

Another blind spot may lie in Romania’s underdeveloped circular economy, which warrants greater attention due to its cross-cutting impact on the energy sector. Strengthening circularity could bridge the gap between Romania’s energy pledges and on-the-ground achievements, reduce dependency on raw materials and fossil fuels, and contribute to improved energy efficiency—enhancing Romania’s performance in the World Energy Trilemma Index.

On a positive note, Romania adopted two key strategic documents in 2024: its Energy Strategy and National Energy and Climate Plan, both with a 2030 outlook. These documents address previously unanswered questions raised by energy leaders, including how Romania intends to accelerate the transition, balance the three pillars of the Trilemma, and roll out energy efficiency measures in line with Directive 2023/1781—particularly through large-scale building retrofits.

ADDRESSING CRITICAL UNCERTAINTIES TO BALANCE THE WORLD ENERGY TRILEMMA

Romania’s energy sector currently demonstrates a relatively balanced Trilemma performance, supported by its geographic advantages, diverse natural resources, and a gradually maturing policy framework. However, commodity prices remain a serious threat to this balance. Ensuring resilience will require continued investments in new and upgraded infrastructure, reduced dependence on fossil fuels, the expansion of renewable energy and storage capacity, and stronger policies for energy efficiency and security.

Acknowledgements

Romania Member Committee

Downloads

Romania Energy Issues Monitor 2025 Country Commentary

Download PDF

Romania World Energy Trilemma Country Profile 2024

Download PDF

Romania Energy Issues Monitor 2024

Download PDF

World Energy Issues Monitor 2024

Download PDF