WEC Lithuania unites the Lithuanian Electricity Association; Lithuanian District Heating Association; Lithuanian Nuclear Energetics Association; Lithuanian Biomass Energy Association LITBIOMA; Lithuanian Energy Consultants Association; The National Association of the Electrical Engineering Business (NETA); Lithuanian Hydropower Association; and the Lithuanian Electricity Producers’ association. WEC Lithuania seeks to unite forces to effectively manage and rationally develop a national energy sector – to supply energy with the most favorable conditions, without compromising future generations to meet national needs in this area, and to represent the interests of the Lithuanian energy sector in the world.

Energy in Lithuania

ENERGY ISSUES IN MOTION

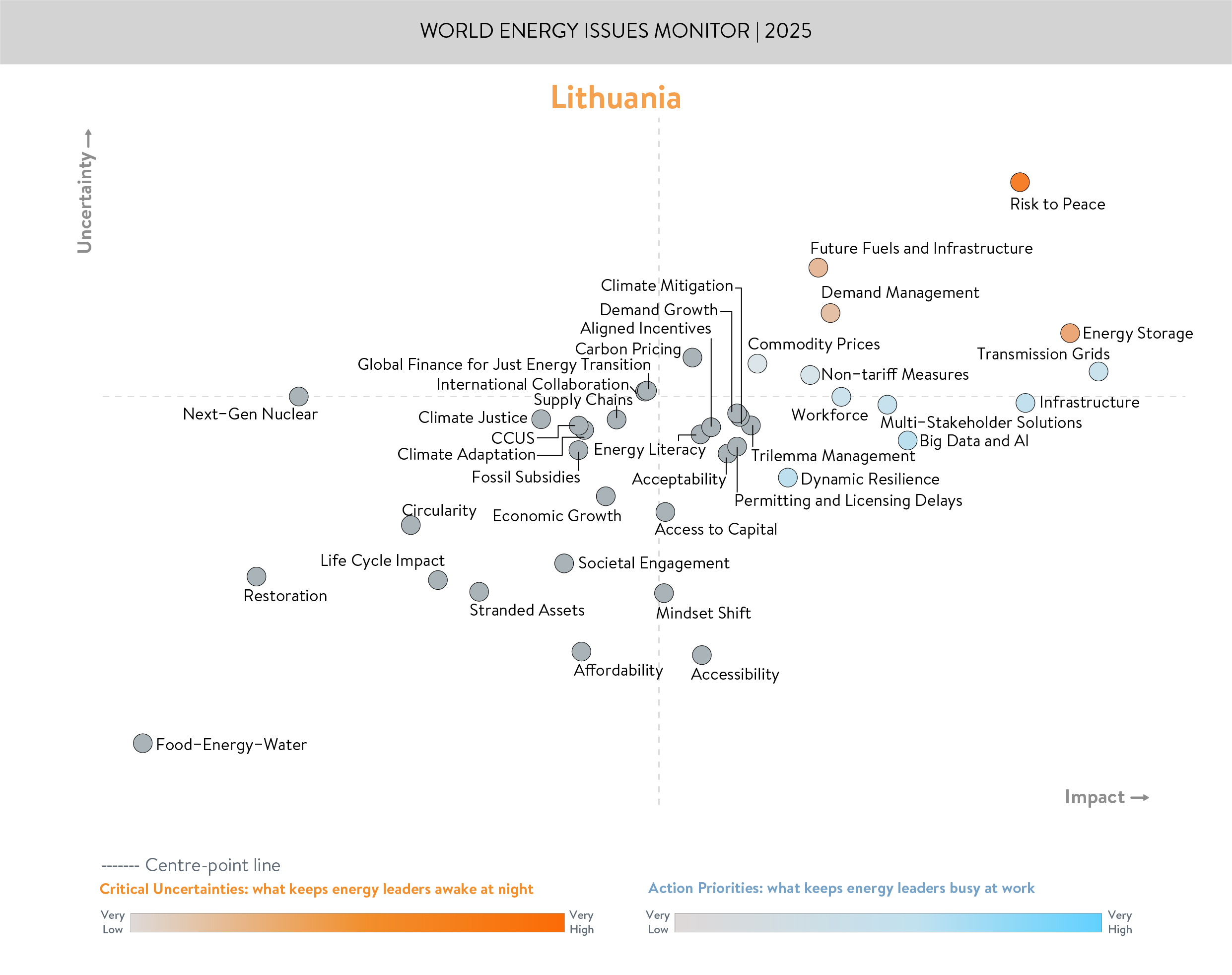

Green energy infrastructure development and the proper protection of the critical energy infrastructure are stressed as critical uncertainties and at the same time action priorities in the updated National Energy Independence Strategy. Focus on innovations should further strengthen the resilience of the sector to all internal and external threats.

Key milestones achieved in 2024 include the completion of the essential projects related to the synchronization of the Baltic electricity network with the Continental European Network (CEN). In this regard, synchronous compensators have been connected to the grid, major reconstruction projects have been completed in eastern and western Lithuania. The Harmony Link project, designed for facilitation of electricity trade, has also been agreed upon by the Lithuanian and Polish TSOs.

In 2024, Lithuania's daily electricity production exceeded its daily consumption for the first time since 2009. Looking at the whole year, for the first time since 2009, national generation has reached almost 60% of national consumption, compared to 33% in 2022 and 45% in 2023. This was possible because in December 2024 the installed capacity of solar and wind power plants reached 3.7 GW, which is 59% more than in 2023. Solar capacity grew by 78.5% year-on-year, while wind capacity grew by 42%.

To further increase national production of electricity, issue of balancing renewables must be solved in the region. Production of green hydrogen and its derivatives is seen as one of the solutions to fix system’s flexibility and reliability. In this regard, a few companies have announced their plans to invest in green hydrogen production, which may start in 2026. On the other hand, complicated European regulations, uncertain prospects for green hydrogen usage and payback have somewhat complicated the vision.

FROM BLIND SPOTS TO BRIGHT SPOTS

Growing domestic energy production saves Lithuania hundreds of millions of euros annually that would otherwise be spent on imported energy sources. With further onshore renewable energy development, Lithuania expects to become a net electricity exporter by 2028. Lithuania is also developing offshore wind capacity in the Baltic Sea with a 700 MW wind tender completed in 2023 and an additional auction planned in 2025.

However, investor interest in the country's renewable energy projects has recently declined. As for instance, leading producer of nitrogen fertilizers in Lithuania and the Baltic states postponed its green hydrogen project after rejecting €122 million of State Aid in European funding. This may be also a result of slower-than-needed growth in industry electrification in the region, raising concerns about the payback of projects. Lower and volatile energy price reduces the attractiveness of market-based investments for RES capacity, making access to financing more difficult. On the other hand, volatile energy prices provide market signals for storage, flexibility and power-to-X development. Therefore, financial support measures have been applied to stimulate investments not only in solar and wind generation, but also in building new storage capacities.

To facilitate the investments into green electricity generation, Lithuanian TSO outlined nearly €7-9 billion for transmission grid modernization over the next decade. Investment is aimed at enabling the increase of onshore renewable energy capacity connected to the grid up to 12 GW, offshore wind capacity up to 1.4 GW, flexible resources capacity up to 12.2 GW, and interconnection capacity up to 3.5 GW by 2035. Consequently, the TSOs are focusing on the development of the Nordic-Baltic Hydrogen Corridor (NBHC) and continue discussions with the Baltic states on the construction of an undersea electricity interconnection to Germany. Lithuanian DSO also accelerates grid renovation and cabling processes due to increasing frequency of natural disasters.

ADDRESSING CRITICAL UNCERTAINTIES TO BALANCE THE ENERGY TRILEMMA

The turbulent geopolitical situation and the risks that are posed to the state by external forces may be classified as critical uncertainty that effects the developments in the country’s energy sector. Therefore, Lithuania has intensified efforts to implement projects that are aimed to increase the resilience of the energy system. In this context, anti-drone systems are being installed at strategic sites, protective walls are being built, equipment reserves are being accumulated. In 2024, as part of its cybersecurity concerns, the Parliament banned access to remote control of solar and wind farms as well as battery management systems with a capacity of more than 100 kW by companies from countries that pose a threat to national security.

The success of renewable energy development depends on the development of short-term and long-term energy storage, electrification, additional cross-border energy infrastructure, power-to-X and hydrogen technologies and projects. In this regard the development of electricity storage facilities in Lithuania was a major focus in 2024. Market participants have reserved 2,7 GW (5,7 GWh) of battery storage capacity to be developed by 2030. In addition, preparatory work has been carried out for the expansion of pumped storage facilities and the development of financial instruments to support battery energy storage system development. The National Energy Independence Strategy, the National Energy and Climate Plan, and other strategic documents noted a few more innovative solutions for storing and generating electricity. For example, an underground compressed air storage system and next-generation small modular nuclear reactors are mentioned as possible projects to be implemented for the purposes related to energy security and environmental sustainability.

Energy equity related issues are being addressed by started work on the new modern and flexible power plant in the Baltic region, which could deliver flexible power generation required to enable even more renewables as well as manage the final electricity price for consumers. Following the completion of the acquisition of the Klaipėda LNG terminal FSRU Independence in December 2024, the natural gas sector highlighted the long-term importance of this fuel for the country's electricity sector. All these instruments are expected to help manage the risks associated with fluctuations in electricity generation and consumption, as well as potential energy shortages or surpluses.

Acknowledgements

Lithuania Member Committee

Downloads

Lithuania Energy Issues Monitor 2025 Country Commentary

Download PDF

World Energy Issues Monitor 2025

Download PDF